Challenges

-

High costs from paper reliant customer communications.

-

Creating a secure space for customers to share information with loved ones and other advisors.

-

Creating an engaged customer-base to support generational wealth capture.

Solutions

-

Enabled digital communications within the client’s platform, routing all previously paper communications into the existing experience, without interruption.

-

Enabled customers to give permissioned access to documents and data for their loved ones, as well as other professional advisors within the client’s platform by embedding our modular vault, creating a secure, intuitive experience for document sharing.

-

Elevating the engagement and the deepening the relationship with customers by enabling a more connected experience, with greater utility, and ongoing relevant notifications to bring customers back to the experience.

Why were we needed?

The Client approached Legado as they needed a way for their investment customers to receive digital documentation (to replace the outgoing paper-based documents), and to be able to share access to those investment documents with their loved ones and other professional advisors. The Client needed a platform that could provide this capability with industry leading security, and with an advanced permissioning layer to ensure that customers could share exactly the right information and access, with exactly the right people.

The Client was suffering from low engagement with their customers, faced severe cost and complexity through fragmented communications channels to deliver documents to their different customer types, and had major need to be able to enhance their relationships with customers to enable the retention of capital through inter-generational wealth transfer.

What did we do?

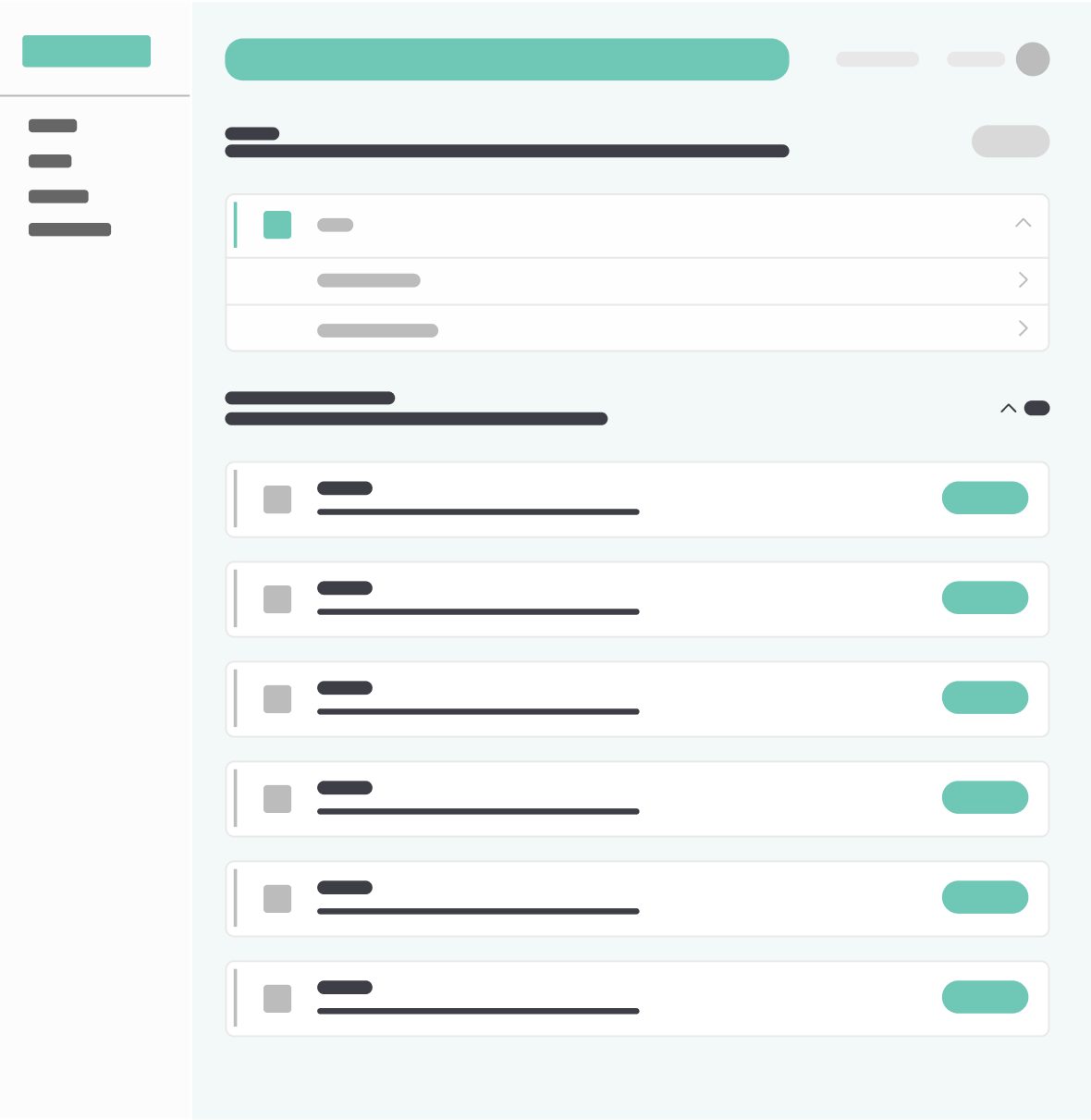

We partnered with the Client to meet their needs using our Digital Vault and Interactive Hub capability. We connected the Interactive Hub to the Client’s investment platform to allow for the encrypted delivery of all documentation, across all customer types, to be delivered via a single within their digital experience. This enabled the Client’s administrative staff to insource their management of communications, with bulk upload, mail merge personalisation, and advanced features like revoking and versioning, as well as our full analytics suite so that the Client’s administrative team can understand exactly how customers are engaging with communications.

We seamlessly embedded the Digital Vault into the Client’s advised digital experience, providing their customers with a modernised and intuitive way to interact with their investment documentation, receive new communications, and manage their personal life admin within the experience.

Our notifications framework keeps the Client’s customers updated when new communications and data have been made available to them, and prioritises bringing the customer back to the investment platform. We leveraged the Digital Vault’s out the box sharing capability with advanced permissioning to deliver the connected investment experience that the Client required. Using our sharing capability, investment customers can share specific elements, or their entire experience, with loved ones and other professional advisors – adding a layer of connectivity and utility to the investment experience that has elevated the Client’s investment proposition.

What was the impact

- 90%reduction in communication costs

- 3x increase in customer engagement

- 5x increase end-customer satisfaction due to added utility within

- 400% increase in engagement with customers’ closest family

- Seamlessly embedded into the Client’s investment platform

- Eliminated paper communications

- Eliminated operational complexity resulting from fragmented communication channels

- Market leading consumer duty evidencing for consumer understanding built-in